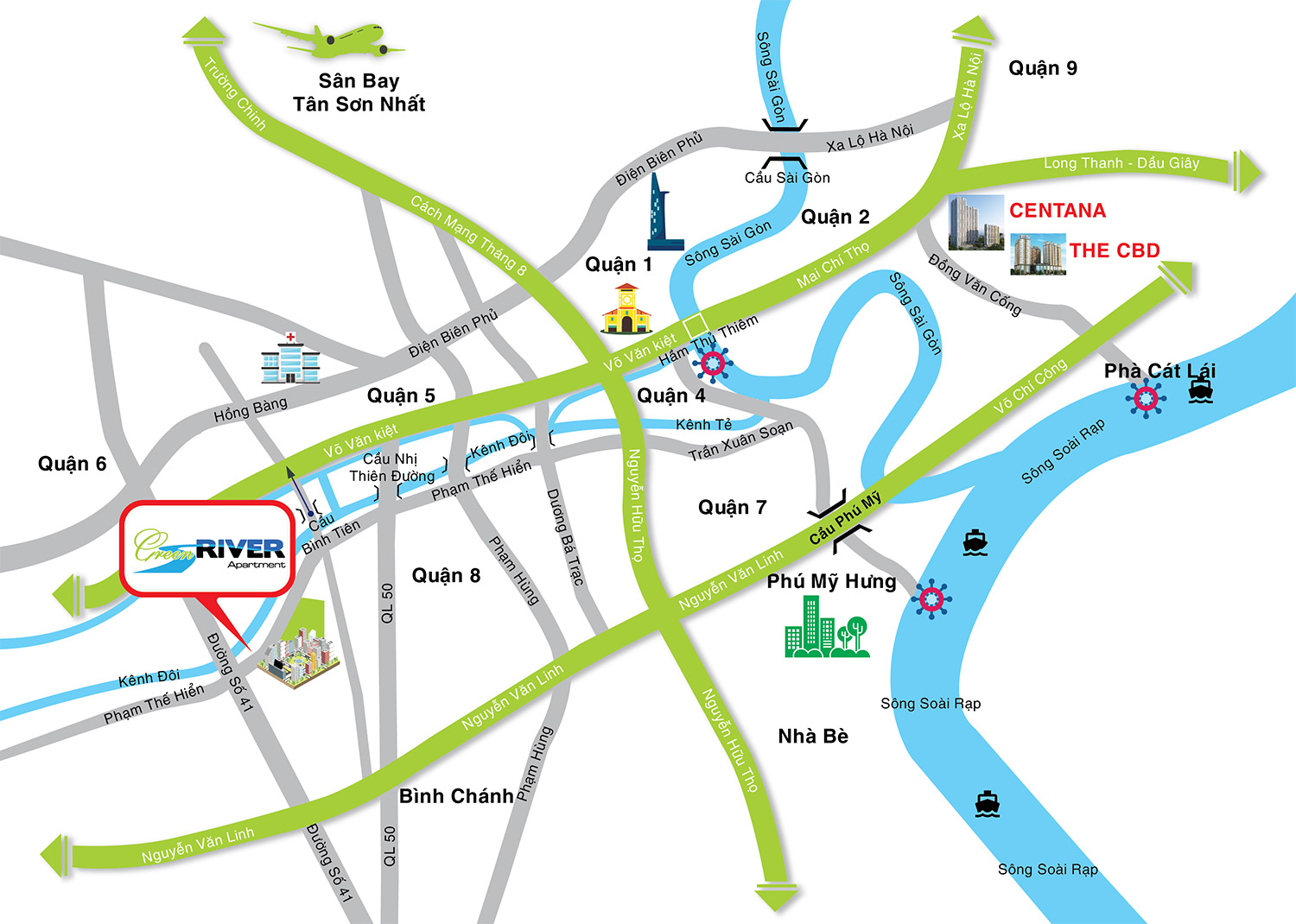

➜ Located in the key economic area of District 8, adjacent to District 4, District 7 and District 5 about 10km from District 1 center.

➜ It only takes a few minutes to reach major commercial centers, crowded markets such as Ben Thanh, An Dong, major hospitals such as Cho Ray, French-Vietnam and high school or university.

➜ Located in the traffic area of Nguyen Van Linh, East-West Highway, Trinh Quang Nghi, Ho Hoc Lam, Highway 50.

Location of Green River project is convenient to move anywhere in Ho Chi Minh City

View location Green River project on map

FEATURED NEWS

Germany “overtakes” Britain becomes the most exciting real estate market in Europe

In the end of 2016, the German real estate market surpassed the total value of € 59 billion, becoming Europe’s most active commercial real estate market.

By the end of 2016, Germany has become a safe market in Europe due to its strong economic growth and relatively stable political and real estate market diversity. So although the investment volume fell 14% earlier this year, however, global real estate consultant Knight Frank still believes that 2017 will also be a “flourishing” year for Germany.

So, what makes Germany “overtake” Britain to become the most exciting real estate market in Europe? Learn with Homedy right in the article below:

In 2016, about 55% of total trading volume was spread over 7 key cities including Berlin, Hamburg, Munich, Cologne, Dusseldorf, Stuttgart and Leipzig. Especially with a midsize city like Leipzig, it can be said that last year attracted huge investment unprecedented.

More than 60% of investment transactions in 2016 involve German investors compared to foreign investors. The evidence is in Berlin, Munich and Frankfurt, the segment of rental housing, office rent growth strongly.

Berlin has become a popular European innovation center, meaning the number of offices has increased the most in the past three years, convincing investors with a total transaction value of 5.7 billion Euro in 2016.

Along with the growth of Berlin, Frankfurt is in no hurry to become a city with more than 230 national and international banking institutions headquartered in 2016. Achieving the highest rental rates since the crisis Global financial year 2007 with a total area of 530,000m2.

In fact, about 4.7 billion euros have been invested in commercial property in Frankfurt in 2016 and although office investment has been limited, the office sector still attracts 3.3 billion euros.

Meanwhile, Munich is Germany’s second largest employment hub, with about 30,000 jobs created annually. Therefore, the segment of office leasing is always in high demand throughout the country. A total of 780,000 sq m of leased office space by 2016, this is considered to be one of the highest totals ever recorded. Munich became Germany’s second most prominent destination for investors, with a total value of 5.5 billion euros.

Conclude

James Roberts, Knight Frank’s economist, said: “Germany is one of the leading economies that will become the leading destination for real estate investors in Europe by 2016.” .

On the same issue, Joachim von Radecke, head of research for the major European property markets of Knight Frank, said: “With seven key cities with distinct characteristics of occupational needs, Continue to help Germany make important differences compared to other European markets.

Accordingly, with seven key cities and the leading advanced economy, 2017 promises to remain a vibrant year of excellence in the German market. Reach the number of transactions beyond expectations and master the leading position in Europe.

Hope the information above will be useful to you!

Source (Internet)

How did the election result affect the UK real estate market?

Experts said the results of the election could cause the real estate transactions in England to slow down. However, this effect may not last.

Political turmoil tends to curb activities in the housing market, especially when these fluctuations take place in the summer – the peak season of real estate transactions. Uncertainty after the results of the vote on June 8 will almost certainly make British real estate market decline.

Alex Gosling, Managing Director of HouseSimple.com, commented: “The slowdown in supply and a hanging parliament will undoubtedly have a negative impact on the UK property market, which is exactly what the market is up to. This is facing. ”

According to Gosling, the uncertainty of the political outlook makes both buyers and sellers afraid to make a decision to buy or sell a home. Due to the psychological wait, observing the market situation of the British people, trading activity on the property market has signs of slowing down.

However, mortgage lenders are still confident that this “political snowstorm” will soon be over, and the market will quickly stabilize. Real estate transactions are not going to be affected by political instability as a result of the election.

With attractive mortgage lending policies, first-time buyers with real needs will still hunt for homes instead of waiting, watching the political situation.

Real estate expert Sarah Beeny, owner of Tepilo.com, said: “I do not think that the election will have a lasting impact on the housing market. The next few weeks, when the political situation has stabilized.

Brian Murphy, chief financial officer of the Mortgage Advice Bureau, said, “If you look at past” political shocks, “there is very little that actually changes. No new laws passed overnight. Therefore, it may be only in the next week that the market will resume normal operations. ”

By: (Tuoi Tre Online)

‘

US: Real estate developer no longer land to build new housing

The real estate developers are unable to build new homes as they are nearing the bottom of the land where people often want to live so many people who want to buy a home in the United States have been struggling in recent years.

According to Bloomberg, many of the cities that expanded before the Great Depression were expanding, and cities with limited space were running out of space to build. This fact motivates real estate developers to focus on downtown areas where high density building is allowed. This makes new homes very expensive.

Issi Romem expert at BuildZoom said that many gaps in urban areas will soon run out of space. US cities generally expand at the edge as property developers often expand in the frontal areas, and then fill in the gaps of subsequent housing developments. As the urban sprawl in the South and South West landed construction, developers just went further.

Many cities like Austin, Nashville, Texas, Tennessee have been witnessing a boom in the inner city. Within 48 kilometers of the city center, new home sales fall between 2000 and 2015. In addition to the radius, sales are up more than 50%. The same trend appears in many other cities, including Atlanta, Phoenix and San Antonio, to varying degrees.

However, in the most expensive cities in the United States, the dynamic said reversed. Construction trends in places like New York City are tightly centered on the metropolitan area where high density building permits. These cities stopped geographically a decade ago, making it impossible for the construction industry to focus on the available space within the metropolitan area.

When empty plots can be built up increasingly difficult to find, price increases, and the ability for developers to make a profit, real estate developers often take building densities to offset land prices. This means focusing on high-end apartments that yield higher margins and only the rich get enough money to buy a flat and this creates a vicious cycle.

Recently, there are some signs of oversupply of apartments and many homeowners in San Francisco, New York have to cut expensive real estate. However, the trend of general prices in the US is still going up. According to Romem, it is unlikely that new housing in the US will be built at affordable prices. This situation makes the residents of the US cities are made difficult in the game to benefit the rich.

“As cities continue to be economically healthy, you will see the poor replaced by wealthier individuals,” said Romem. You will read the story of teachers who can not find accommodation. ”

By (Dan tri Online)

Foreign investors continue to pour capital into real estate

Real estate business continues to hold the second position in attracting foreign investment in Vietnam in the first two months of 2017.

As announced by the Foreign Investment Agency (Ministry of Planning and Investment), in the first two months of the year (as of February 20), 313 new projects were granted investment certificates with total registered capital FDI is 2.028 billion USD, up 6.5% over the same period of 2016. 137 projects registered to increase investment capital with the total registered capital increased $ 759.51 million, 84.5% compared with In the same period of 2016 and 654 times capital contribution, share purchase of foreign investors with a total capital contribution of $ 619 million, nearly four times the same period in 2016.

If accumulated to February 2017, to 20/02/2017, the country has 22,904 valid projects with a total registered capital of 297 billion USD. Accumulated capital of FDI projects is estimated at USD 156.35 billion, equal to 52.6% of total registered capital.

In the first two months of 2017, foreign investors invested in 18 industries, of which the manufacturing and manufacturing sectors were the ones that attracted much attention. Foreign investors with total capital of $ 2.5 billion, accounting for 73.4% of total registered capital in 2 months.

Real estate business ranked second with total investment of $ 345.5 million, accounting for 10.1% of total investment. Third place was the wholesale and retail sector with a total registered capital of US $ 222.6 million, accounting for 6.5% of the total registered capital.

In the first two months of 2017, 61 countries and territories have investment projects in Vietnam. Singapore ranked first with a total investment of $ 881.6 million, accounting for 25.8% of total investment; China ranked second with total registered capital of US $ 721.7 million, accounting for 21.1% of total investment in Vietnam; South Korea ranks third with total registered capital of US $ 637.1 million, accounting for 18.7% of total investment.

Also in the first two months of 2017, Binh Duong was the most attracted foreign investment capital with a total registered capital of $ 791.2 million, accounting for 23.22% of total investment. Hanoi ranked second with a total registered capital of $ 519 million, accounting for 15.2% of total investment. Ho Chi Minh City ranked third with a total registered capital of $ 464.2 million, accounting for 13.6% of total investment.

Source: (Internet)